Congratulations! 🎉

You have just received a job offer from a high-growth startup, and along with your salary, you see a grant of “Employee Stock Options.” 📝

For many, this is the most confusing, yet potentially most valuable, part of their compensation package. 💰

This guide will demystify the world of startup equity, breaking down the complex terminology, tax implications, and the critical decisions you will face. 🧠

Understanding your equity is the first step to maximizing your financial future. 🚀

Article I: The Fundamentals of Employee Equity 💡

Stock options are not actual shares of the company; they are the right to purchase a set number of shares at a predetermined price, known as the Exercise Price or Strike Price. 🎯

Startups use options as a powerful incentive, aligning the employee’s financial success with the company’s growth. 🤝

Section 1.1: Key Terminology Decoded

Before diving into the types of options, it is essential to master the core vocabulary: 🗣️

- Grant Date: The day the company officially awards you the right to purchase the shares.

- Exercise Price (Strike Price): The fixed price per share at which you can purchase the stock, typically set at the Fair Market Value (FMV) on the Grant Date.

- Fair Market Value (FMV): The current, independent valuation of one share of the company’s common stock, often determined by a 409A valuation.

- Vesting: The process of earning your right to the options over time, usually tied to continued employment.

- Cliff: A period (usually one year) during which you must remain employed to vest in the first portion of your options. If you leave before the cliff, you get nothing. 💔

- Exercise: The act of paying the Exercise Price to convert your options into actual shares of company stock.

- Liquidity Event: An event, such as an IPO or acquisition, that allows you to sell your shares for cash. 💸

Section 1.2: The Standard Vesting Schedule

The industry standard for stock option vesting is four years with a one-year cliff. 🗓️

This means you must work for one full year to vest in the first 25% of your options. 🥂

After the cliff, the remaining 75% vests monthly over the next three years. 📅

This structure ensures that employees are incentivized to stay long-term and contribute to the company’s growth. Carta provides a detailed breakdown of how vesting works. [1]

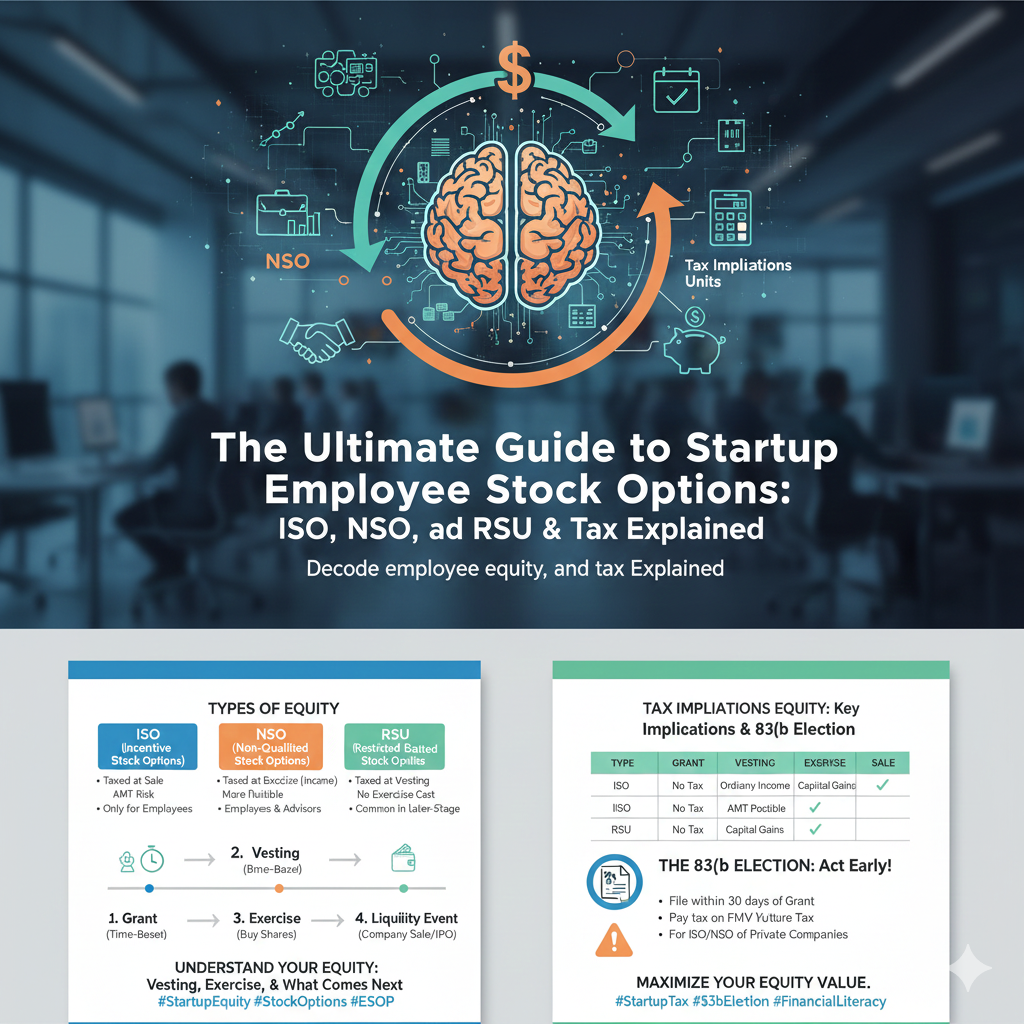

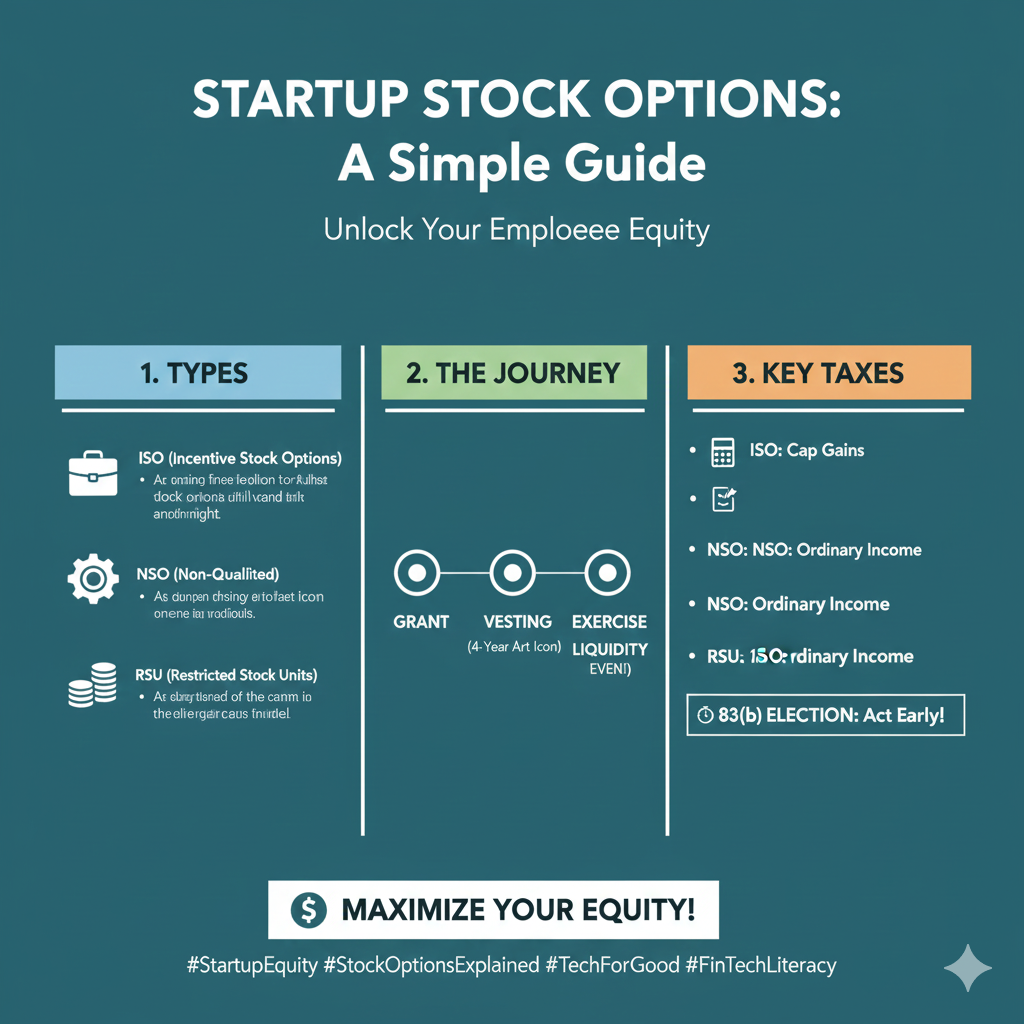

Article II: The Three Main Types of Equity Compensation 📊

Equity compensation comes in several forms, each with distinct legal and tax implications. ⚖️

The three most common types are Incentive Stock Options (ISOs), Non-Qualified Stock Options (NSOs), and Restricted Stock Units (RSUs). 🧐

Section 2.1: Incentive Stock Options (ISOs)

ISOs are the most tax-advantaged type of option, but they come with strict rules. 🌟

They can only be granted to employees, not contractors or advisors. 🧑💼

The primary benefit is that you generally do not owe regular income tax when you exercise the options. 🚫

Instead, the gain is taxed at the lower long-term capital gains rate when you sell the stock, provided you meet two holding requirements: 🗓️

- You must hold the stock for at least one year after the exercise date.

- You must hold the stock for at least two years after the grant date.

However, the difference between the FMV and the Exercise Price at the time of exercise is subject to the Alternative Minimum Tax (AMT), which can be a significant and unexpected tax bill. 🚨

Section 2.2: Non-Qualified Stock Options (NSOs)

NSOs are the most common and flexible type of option. 🤸

They can be granted to employees, contractors, advisors, and board members. 👥

The key difference is the tax treatment: NSOs are taxed at two points. ✌️

First, at exercise, the “spread” (FMV minus Exercise Price) is taxed as ordinary income. 💸

Second, when you sell the stock, any further gain is taxed as a capital gain. 📈

Because the tax is due at exercise, NSOs can require a significant cash outlay before you realize any profit. 🛑

Section 2.3: Restricted Stock Units (RSUs)

RSUs are promises to give you shares of company stock once a vesting schedule is met. 🎁

Unlike options, there is no Exercise Price; you receive the shares for free. 🆓

RSUs are typically used by later-stage or public companies. 🏢

The tax event occurs at vesting: the full Fair Market Value of the shares on the vesting date is taxed as ordinary income. 💰

The company usually withholds a portion of the shares to cover the tax liability. ✂️

| Feature | ISO (Incentive Stock Option) | NSO (Non-Qualified Stock Option) | RSU (Restricted Stock Unit) |

|---|---|---|---|

| Who Can Receive? | Employees only | Anyone (Employees, Contractors, etc.) | Employees only |

| Cost to Acquire? | Must pay Exercise Price | Must pay Exercise Price | No cost (shares are granted) |

| Tax at Exercise? | No regular income tax (but possible AMT) | Ordinary Income Tax on the “Spread” | No tax (shares not yet received) |

| Tax at Vesting? | N/A | N/A | Ordinary Income Tax on FMV |

| Tax at Sale? | Capital Gains (long-term if holding requirements met) | Capital Gains | Capital Gains |

Article III: The Critical Tax Decision: Section 83(b) Election 🏛️

For founders and early employees who receive restricted stock or options that can be exercised early (before vesting), the Section 83(b) Election is a game-changer. 🎲

This is one of the most important, and time-sensitive, decisions you will make regarding your equity. ⏳

Section 3.1: What is the 83(b) Election?

Normally, you are taxed on the value of your stock when it vests. 💸

The 83(b) Election allows you to tell the IRS that you want to be taxed on the value of your restricted stock on the grant date, rather than the vesting date. 📅

For early-stage startups, the FMV of the stock at the grant date is often extremely low, sometimes just a fraction of a penny. 🤏

By filing the 83(b) election, you pay a minimal amount of tax upfront. 🤏

All future appreciation of the stock is then treated as long-term capital gains, which are taxed at a much lower rate than ordinary income. 📉

This can save you a fortune if the company is successful. 🤑

Section 3.2: The 30-Day Deadline

The most critical rule of the 83(b) election is the deadline: you must file the election with the IRS within 30 days of the grant date. 🛑

This deadline is absolute and cannot be extended, regardless of the circumstances. ❌

Missing this deadline means you lose the opportunity to take advantage of this tax benefit. 😭

Always consult a tax professional immediately upon receiving a restricted stock grant. 🤓

Article IV: The Employee’s Equity Journey: From Grant to Sale 🗺️

Understanding the full lifecycle of your stock options is essential for strategic planning. ♟️

The journey can be broken down into four distinct phases: 4️⃣

Section 4.1: Phase 1 – The Grant

You receive your option grant letter, which specifies the number of options, the Exercise Price, and the vesting schedule. 📜

Your first year of employment is the “cliff” period, where you are working toward your first 25% of vested options. 🧗

Section 4.2: Phase 2 – Vesting

Once you pass the one-year cliff, your first 25% vests, and you begin monthly vesting thereafter. 🥳

At this point, you have the right to exercise (purchase) the vested options. 🛒

The decision to exercise is complex, involving cash outlay, tax implications (especially for NSOs and ISOs), and the risk of the company failing. ⚠️

The difference between the FMV and your Exercise Price is called the “in-the-money” value. 💵

Section 4.3: Phase 3 – Exercise

To exercise, you pay the Exercise Price for the number of vested options you wish to convert into shares. 💳

For NSOs, this is the point where ordinary income tax is due on the spread. 📉

For ISOs, this is the point where you may trigger the Alternative Minimum Tax (AMT). 💡

Once exercised, you become a shareholder, subject to the company’s shareholder agreement. 🧑🤝🧑

You now own restricted stock, which you cannot sell until a liquidity event. 🔒

Section 4.4: Phase 4 – Liquidity Event and Sale

A liquidity event (IPO or acquisition) is the moment you can finally sell your shares for cash. 💸

If you have held the stock long enough to qualify for long-term capital gains treatment, your profit will be taxed at the lowest possible rate. 🏆

The profit is calculated as the sale price minus your cost basis (which is the FMV at exercise for NSOs, or the Exercise Price for ISOs meeting the holding period). 🧮

This is the ultimate goal of accepting stock options as part of your compensation. 🥳

Article V: Strategic Considerations for Employees 🤔

Stock options are a high-risk, high-reward form of compensation. 🎢

Here are key strategic points to consider: 📌

Section 5.1: The Cost of Waiting

The longer you wait to exercise your options, the higher the potential tax bill will be. 📈

As the company grows, the FMV of the stock increases, which increases the “spread” and thus the tax liability at exercise (for NSOs) or the AMT exposure (for ISOs). 💸

Exercising early, even if you have to borrow money, can be a powerful strategy to lock in a low tax basis and maximize long-term capital gains. ♟️

Section 5.2: The Risk of Expiration

If you leave the company, you typically have a limited window—often 90 days—to exercise your vested options. ⏰

If you fail to exercise within this period, your options expire worthless. 🗑️

This “90-day window” is a major source of stress and financial risk for departing employees. 😟

Some progressive startups are now offering extended exercise windows (up to 7 or 10 years) to mitigate this risk. Always check your grant agreement for the post-termination exercise period. 📜

Section 5.3: The Importance of the 409A Valuation

The 409A valuation is the independent appraisal that determines the Fair Market Value (FMV) of your company’s common stock. 🧐

This valuation is crucial because the Exercise Price of your options must be equal to or greater than the 409A FMV on the grant date. ⚖️

If the Exercise Price is set too low, the IRS could retroactively deem your options “discounted,” leading to immediate tax penalties. 🚨

A company that regularly updates its 409A valuation is demonstrating good governance and compliance. ✅

Conclusion: Your Equity is Your Future 🌟

Employee stock options are a powerful tool for attracting and retaining top talent in the startup world. 🏆

They represent a shared belief in the company’s potential and a direct link between your hard work and financial reward. 🔗

However, the complexity of ISOs, NSOs, RSUs, and the critical timing of the 83(b) election mean that you must be proactive. 🧐

Do not treat your equity grant as a lottery ticket; treat it as a serious financial asset that requires careful planning. ♟️

Always seek professional advice from a tax advisor or financial planner who specializes in startup equity. This is not a do-it-yourself project. 🛑

By understanding these mechanisms, you can make informed decisions that maximize your potential return and minimize your tax risk. 🥳

External Resources and References 📚

For further reading and professional guidance on stock options, please consult the following resources: 📖

[1] Carta. Stock Options Explained: Types of Options & How They Work.

[2] Secfi. The complete guide to employee stock option taxes.

[3] Internal Revenue Service (IRS). Topic no. 427, Stock options.

[4] NerdWallet. Incentive Stock Options: How ISOs Work vs NSOs.

[5] Davis Wright Tremaine LLP. What Is an 83(b) Election and Why Should Startup Founders Care?

🌟

Remember to always verify tax information with a qualified professional. 🧑⚖️