The journey of entrepreneurship is filled with critical decisions, but none is as foundational as selecting your business’s legal structure.

This choice is the legal and financial blueprint that governs operations, determines personal liability, and dictates taxation.

A well-chosen structure provides robust protection and maximizes tax efficiency.

This comprehensive guide serves as your ultimate resource for understanding and utilizing a business structure comparison chart.

We will dissect the four primary business entities—Sole Proprietorship, Partnership, Limited Liability Company (LLC), and Corporation—by examining the three most critical factors: liability, taxation, and administrative complexity.

This knowledge will help you confidently select the foundation aligned with your business goals and long-term vision.

The Four Pillars of Business Structure

While countless variations exist, nearly all businesses fall into one of four fundamental categories.

1. Sole Proprietorship

The simplest and most common structure, a Sole Proprietorship is owned and run by one person with no legal distinction between the owner and the business.

It is the default structure for many new ventures.

2. Partnership

A Partnership is a formal arrangement between two or more people who share in the profits or losses.

General Partnerships are easy to form but introduce shared control and shared liability among partners.

3. Limited Liability Company (LLC)

The LLC is a popular hybrid structure combining the pass-through taxation of a partnership with the limited liability protection of a corporation.

This structure shields the owners’ personal assets from business debts and lawsuits.

4. Corporation

The Corporation is the most complex and formal structure, existing as a separate legal entity from its owners (shareholders).

This separation provides maximum personal liability protection but comes with stringent administrative requirements.

Corporations are categorized into C Corporations (C-Corps), which are taxed as separate entities, and S Corporations (S-Corps), which elect to pass income through to shareholders for federal tax purposes.

The Critical Comparison Factors

To select the right structure, we must compare them across the three most critical dimensions: liability, taxation, and administrative complexity.

Factor 1: Personal Liability and Asset Protection

Liability is arguably the most important factor, determining the extent to which your personal assets are at risk from business debts or lawsuits.

Unlimited Liability: The Risk of Exposure

Sole Proprietorships and General Partnerships expose owners to unlimited personal liability.

Since the owner and the business are legally inseparable, business debts and judgments become the owner’s personal responsibility.

Creditors can pursue the owner’s home, savings, and other personal assets.

Limited Liability: The Shield of Separation

The LLC and the Corporation (C-Corp and S-Corp) provide limited liability protection.

The business is treated as a separate legal entity, meaning the owners’ personal assets are generally protected from the company’s financial and legal obligations.

This legal “shield” is the primary driver for choosing these more formal structures.

Factor 2: Taxation and Financial Flexibility

The tax treatment significantly impacts the owner’s overall tax burden, following two primary models: pass-through and corporate taxation.

Pass-Through Taxation

Sole Proprietorships, Partnerships, and by default, LLCs, use “pass-through” taxation.

The business’s profits and losses are reported directly on the owners’ personal income tax returns (e.g., Schedule C for a Sole Proprietorship, K-1 for a Partnership/Multi-member LLC).

The business entity itself does not pay federal income tax, though owners are responsible for self-employment taxes.

The LLC’s flexibility allows it to elect to be taxed as an S-Corporation or a C-Corporation.

Corporate Taxation and Double Taxation

A C-Corporation is subject to corporate taxation.

The corporation pays income tax on its profits at the corporate tax rate.

When the remaining profits are distributed to shareholders as dividends, those shareholders pay personal income tax on the dividends.

This is the issue of “double taxation.”

The S-Corp Election: A Tax Advantage

The S-Corporation election is a popular strategy for small businesses.

It allows a corporation (or an LLC electing the status) to maintain limited liability while benefiting from pass-through taxation, avoiding double taxation.

A key advantage for profitable businesses is the potential to reduce self-employment tax by dividing owner compensation into a reasonable salary (subject to payroll tax) and a distribution (not subject to self-employment tax).

Factor 3: Administrative Complexity and Compliance

The administrative burden, encompassing paperwork, meetings, and compliance requirements, increases with the structure’s complexity.

Minimal Complexity

The Sole Proprietorship has the lowest administrative burden, requiring only accurate record-keeping and annual tax filings (Schedule C).

Moderate Complexity

Partnerships require a detailed partnership agreement to govern operations.

LLCs require filing Articles of Organization and paying annual state fees.

While less formal than corporations, LLCs must maintain clear separation between personal and business finances to preserve the liability shield (“piercing the corporate veil”).

High Complexity

Corporations (C-Corps and S-Corps) have the highest administrative complexity.

They must adhere to strict corporate formalities, including: filing Articles of Incorporation, establishing bylaws, appointing a Board of Directors, and holding regular, documented board and shareholder meetings.

This compliance is mandatory to maintain the liability shield and often necessitates ongoing legal and accounting support.

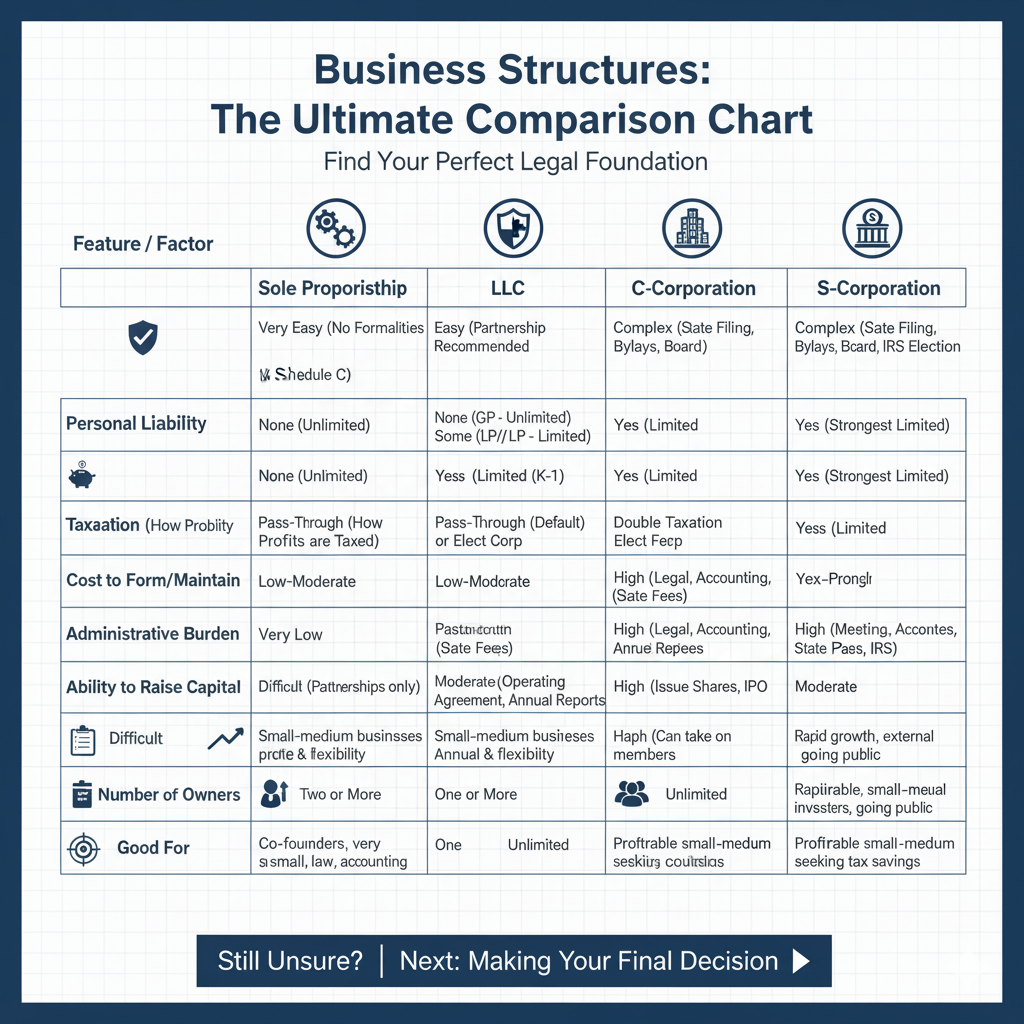

Detailed Business Structure Comparison Chart

The following chart synthesizes the critical differences across the four core structures, providing a clear, side-by-side comparison to aid your decision-making process.

| Feature | Sole Proprietorship | General Partnership | Limited Liability Company (LLC) | Corporation (C-Corp) |

|---|---|---|---|---|

| Legal Status | Not a separate legal entity. | Not a separate legal entity. | Separate legal entity from owners (members). | Separate legal entity from owners (shareholders). |

| Personal Liability | Unlimited (Owner’s personal assets are at risk). | Unlimited (Partners’ personal assets are at risk). | Limited (Members’ personal assets are protected). | Limited (Shareholders’ personal assets are protected). |

| Taxation | Pass-Through (Schedule C). | Pass-Through (Form 1065, K-1). | Flexible: Pass-Through (default) or Elective (S-Corp/C-Corp). | Corporate Tax Rate (Subject to Double Taxation). |

| Administrative Burden | Lowest (Minimal paperwork, no meetings). | Low (Requires a Partnership Agreement). | Moderate (Articles of Organization, annual state fees). | Highest (Articles of Incorporation, bylaws, board meetings, minutes). |

| Ownership | Single owner. | Two or more partners. | One or more members (no limits on type or number). | Unlimited shareholders (including foreign and corporate entities). |

| Ability to Raise Capital | Very difficult (Limited to personal loans/assets). | Difficult (Limited to partner contributions/loans). | Moderate (Can sell membership interests). | Highest (Can sell stock, attract venture capital). |

| Life of the Business | Ends with the death or exit of the owner. | Ends with the death or exit of a partner (unless specified otherwise). | Continues regardless of changes in members. | Perpetual existence. |

Making the Right Choice: A Structural Decision Tree

Selecting the best structure is a strategic process that should be guided by your answers to a few key questions:

1. How much risk is involved in your business? (The Liability Question)

- Low Risk: If your business has minimal risk of lawsuits or debt (e.g., a freelance writer or a small Etsy shop), a Sole Proprietorship or General Partnership might be acceptable due to their simplicity.

- Moderate to High Risk: If you deal with physical products, client contracts, or significant debt, Limited Liability is non-negotiable. The LLC or Corporation is the mandatory choice to protect your personal wealth.

2. How do you plan to handle taxes? (The Taxation Question)

- Simplicity is Key: If you want the easiest tax filing, the default Sole Proprietorship or Partnership pass-through model is best.

- Tax Efficiency: If you want to optimize for tax savings, especially by reducing self-employment tax, an LLC electing to be taxed as an S-Corp is often the most beneficial choice for a profitable small business.

- Investment and Reinvestment: If your goal is to retain earnings within the business for massive growth and reinvestment, and you plan to attract large-scale investors, the C-Corporation is the required structure, despite the double taxation.

3. Do you plan to seek outside investment? (The Growth Question)

- Self-Funded/Small Loans: The LLC structure is perfectly adequate for businesses funded by owners, friends, family, or small bank loans.

- Venture Capital/IPO: If your long-term goal involves securing funding from venture capital firms or eventually going public (Initial Public Offering), you must form a C-Corporation. Investors and the stock market are structured to deal with the C-Corp model.

The Power and Flexibility of the LLC

The Limited Liability Company (LLC) has become the structure of choice for the vast majority of new small-to-medium-sized businesses.

Its popularity is due to its ability to offer the best of both worlds: the limited liability of a corporation and the tax simplicity of a partnership.

The LLC also offers unparalleled flexibility in management (member-managed or manager-managed) and tax classification (Sole Proprietorship, Partnership, S-Corp, or C-Corp).

This versatility makes the LLC a powerful and safe foundation for almost any startup that does not have immediate plans for venture capital funding.

Conclusion: Build Your Foundation Wisely

The business structure comparison chart is a strategic roadmap for your business’s future.

The decision you make today will determine your financial exposure, tax obligations, and capacity for growth.

The Limited Liability Company (LLC) offers the ideal balance of personal asset protection and administrative ease for the vast majority of entrepreneurs.

The Sole Proprietorship remains the simplest path for freelancers and very small operations.

However, if you are building a high-growth company with plans for massive scale and venture funding, the C-Corporation is the only viable option.

Take the time to assess your risk, project your profitability, and understand your long-term goals.

By using this comparison guide, you can ensure your business is built on a solid, legally sound foundation, allowing you to focus on growing your enterprise.

References

- [1] U.S. Small Business Administration (SBA). Choose a business structure.

- [2] Internal Revenue Service (IRS). Business Structures.

- [3] LegalZoom. Difference Between Sole Proprietorship, Partnership, and Corporation.

- [4] Thomson Reuters. S Corp vs. C Corp vs. LLC: What’s the difference and which one is better for your business?.

- [5] Experian. Differences Between Corporation, Sole Proprietorship, Partnership.