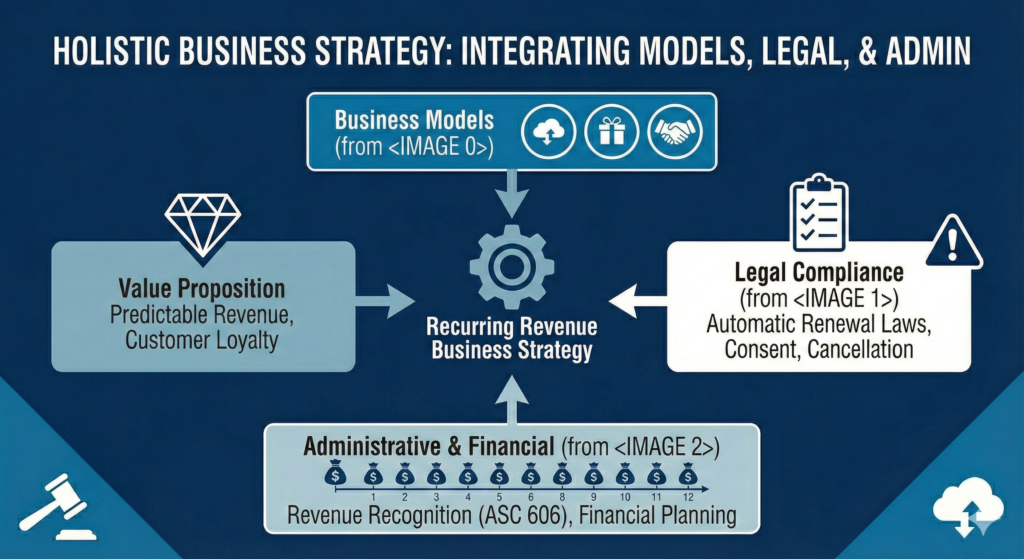

The pursuit of predictable income is the holy grail of modern business strategy. 👑

For entrepreneurs and established companies alike, shifting from one-time transactions to a recurring revenue model (RRM) is a fundamental step toward stability and exponential growth.

A recurring revenue model ensures a consistent, predictable cash flow, which is invaluable for financial planning and valuation.

However, this shift introduces a complex layer of administrative and legal considerations that must be meticulously managed. ⚖️

It is not enough to simply charge a monthly fee; businesses must navigate regulatory compliance, revenue recognition standards, and consumer protection laws, particularly those governing automatic renewals.

This in-depth guide explores the most successful recurring revenue models and provides a critical look at the legal and administrative infrastructure required to support them effectively.

The Foundation: Understanding Recurring Revenue Models 💰

A recurring revenue model is a business strategy where customers are charged a regular fee for continued access to a product or service.

This predictability is the core benefit, allowing businesses to forecast revenue with greater accuracy and secure better financing.

Stripe defines recurring revenue models as those that charge customers regularly for a product or service, generating consistent, predictable revenue streams. This stability is a key indicator of business health.

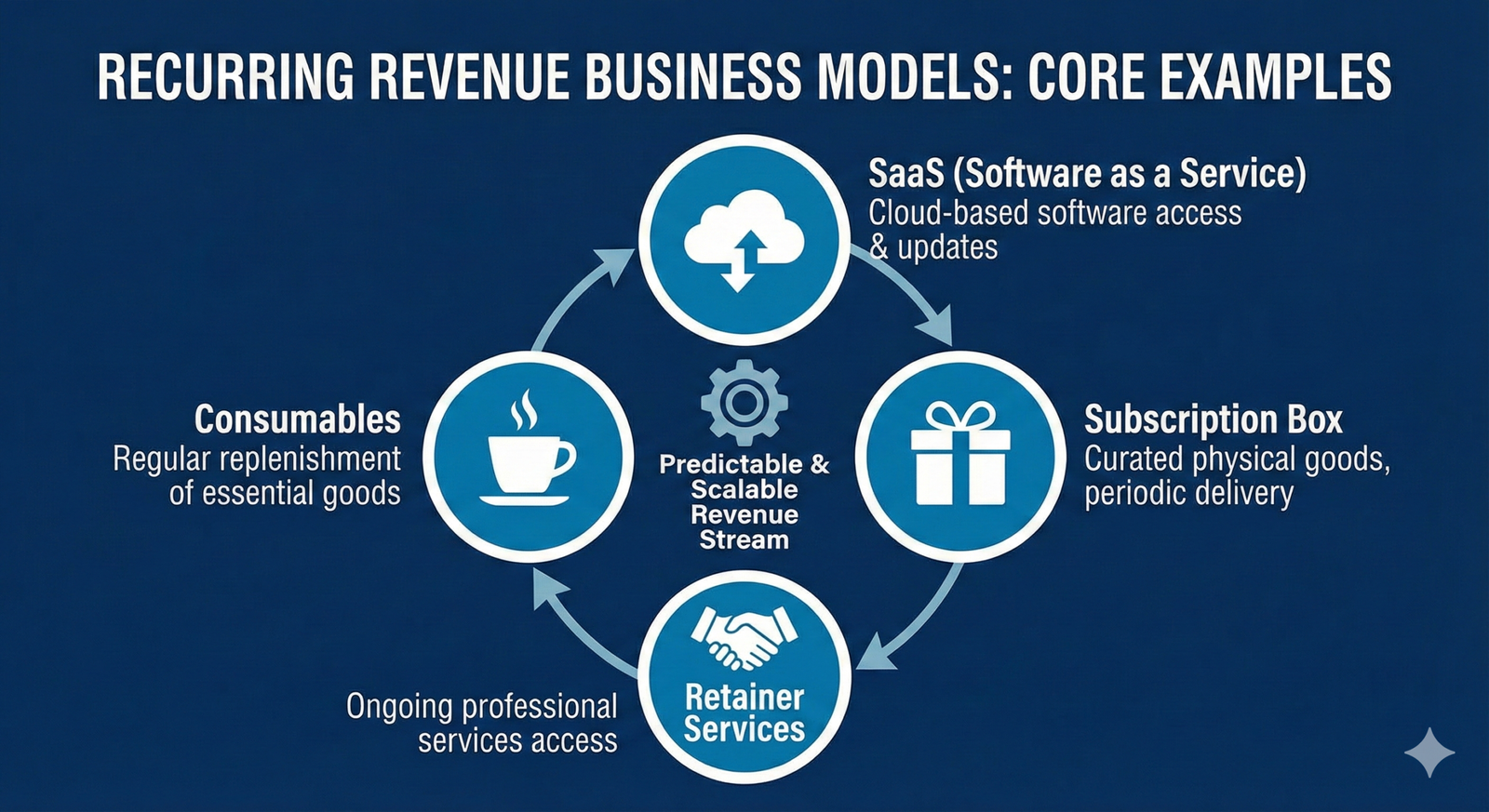

Key Examples of Recurring Revenue Models 💡

While the Subscription model is the most famous, several distinct models fall under the RRM umbrella.

Each model has unique pricing, delivery, and administrative requirements.

- Subscription Model (SaaS, Media, Boxes): Customers pay a fixed fee for access to a service or product over a defined period. This is the model used by Netflix, Adobe Creative Cloud, and meal kit services.

- Usage-Based Model (Consumption): Customers are charged based on how much they use the service, often with a low base fee. Examples include cloud computing services (AWS, Azure) or utility companies.

- Retainer Model (Services): Common in professional services like legal, marketing, or consulting, where a client pays a fixed monthly fee to secure a certain amount of work or priority access to expertise.

- Consumables/Replenishment Model: The customer automatically receives a physical product on a recurring schedule, such as razor blades, coffee beans, or pet food.

- Membership Model (Community/Content): Similar to subscription but often focused on exclusive access to a community, premium content, or specialized knowledge, such as a paid newsletter or a private forum.

Selecting the right model depends entirely on the nature of the product and the value proposition offered to the customer.

Administrative Challenges: The Operational Backbone ⚙️

The shift to RRM requires a complete overhaul of traditional administrative processes.

The focus moves from managing individual sales orders to managing the entire customer lifecycle.

This involves specialized software and meticulous attention to financial reporting.

1. Subscription Billing and Management

Handling recurring payments is far more complex than processing a single transaction.

The administrative system must manage different billing cycles (monthly, quarterly, annual), prorated charges, discounts, and upgrades/downgrades.

Crucially, it must handle “dunning,” the process of recovering failed payments, which is a major administrative burden and a key factor in churn.

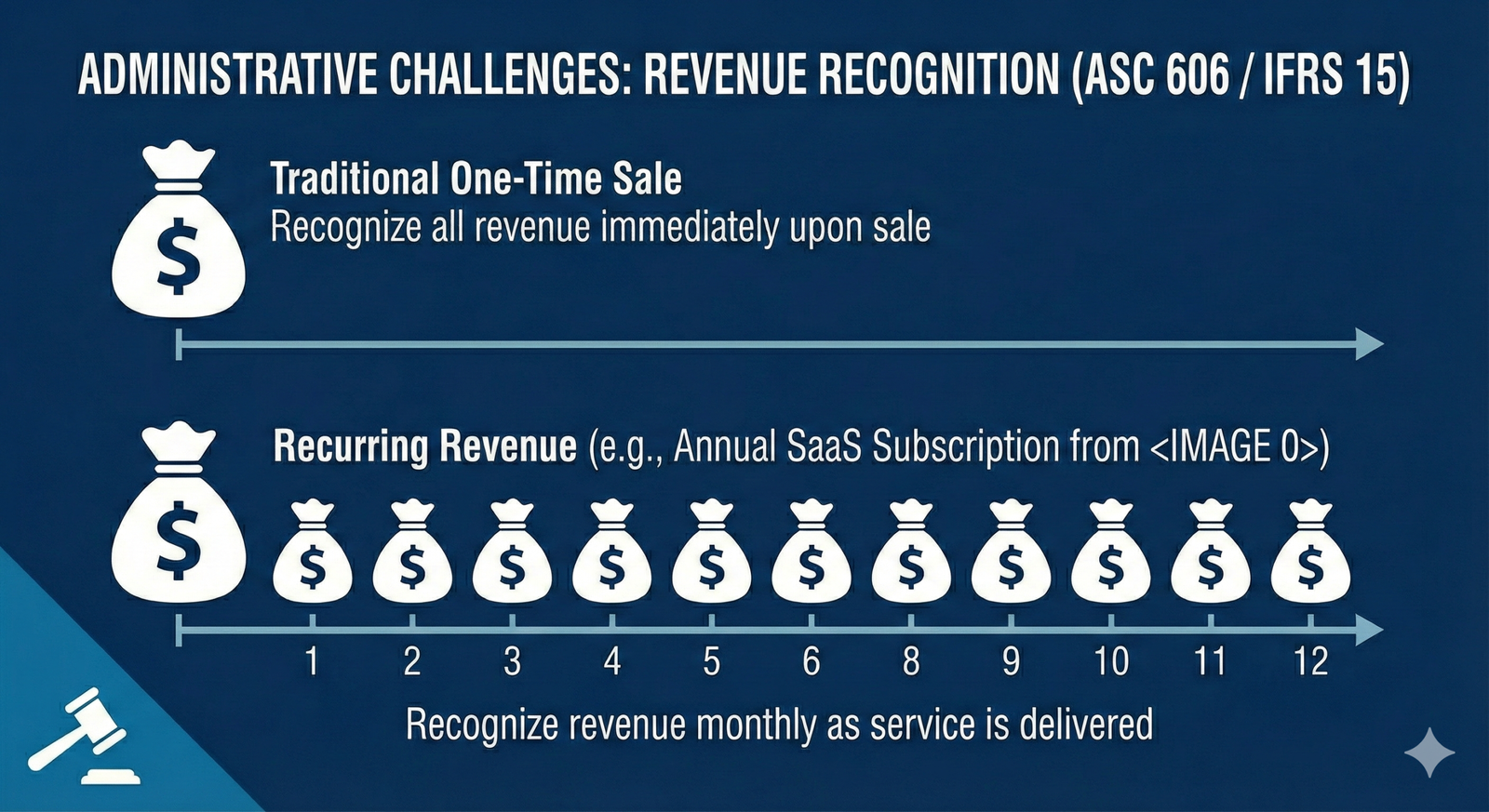

2. Revenue Recognition Compliance

This is arguably the most significant administrative and legal challenge.

Under accounting standards like ASC 606 (US GAAP) and IFRS 15, revenue from a subscription must be recognized over the period the service is delivered, not when the cash is received.

If a customer pays $120 for an annual subscription upfront, the business can only recognize $10 of that revenue each month.

This requires sophisticated accounting software to track deferred revenue and ensure compliance, which is vital for audits and investor relations.

3. Customer Lifecycle Management (CLM)

The administrative focus shifts to Customer Lifetime Value (CLV) and churn rate.

The system must track when customers join, upgrade, downgrade, or cancel.

High churn rates can quickly negate the benefits of recurring revenue.

Administratively, this means integrating billing data with CRM and support systems to identify at-risk customers proactively.

| Administrative Focus | Key Metric | Software Requirement |

|---|---|---|

| Billing & Payments | Churn Rate (especially involuntary churn) | Subscription Management Platform (e.g., Chargebee, Recurly) |

| Financial Reporting | Monthly Recurring Revenue (MRR) & Deferred Revenue | ERP/Accounting System with ASC 606 compliance |

| Customer Relations | Customer Lifetime Value (CLV) & Net Promoter Score (NPS) | Integrated CRM System (e.g., Salesforce, HubSpot) |

Without robust administrative tools, the complexity of RRM can quickly overwhelm a growing business.

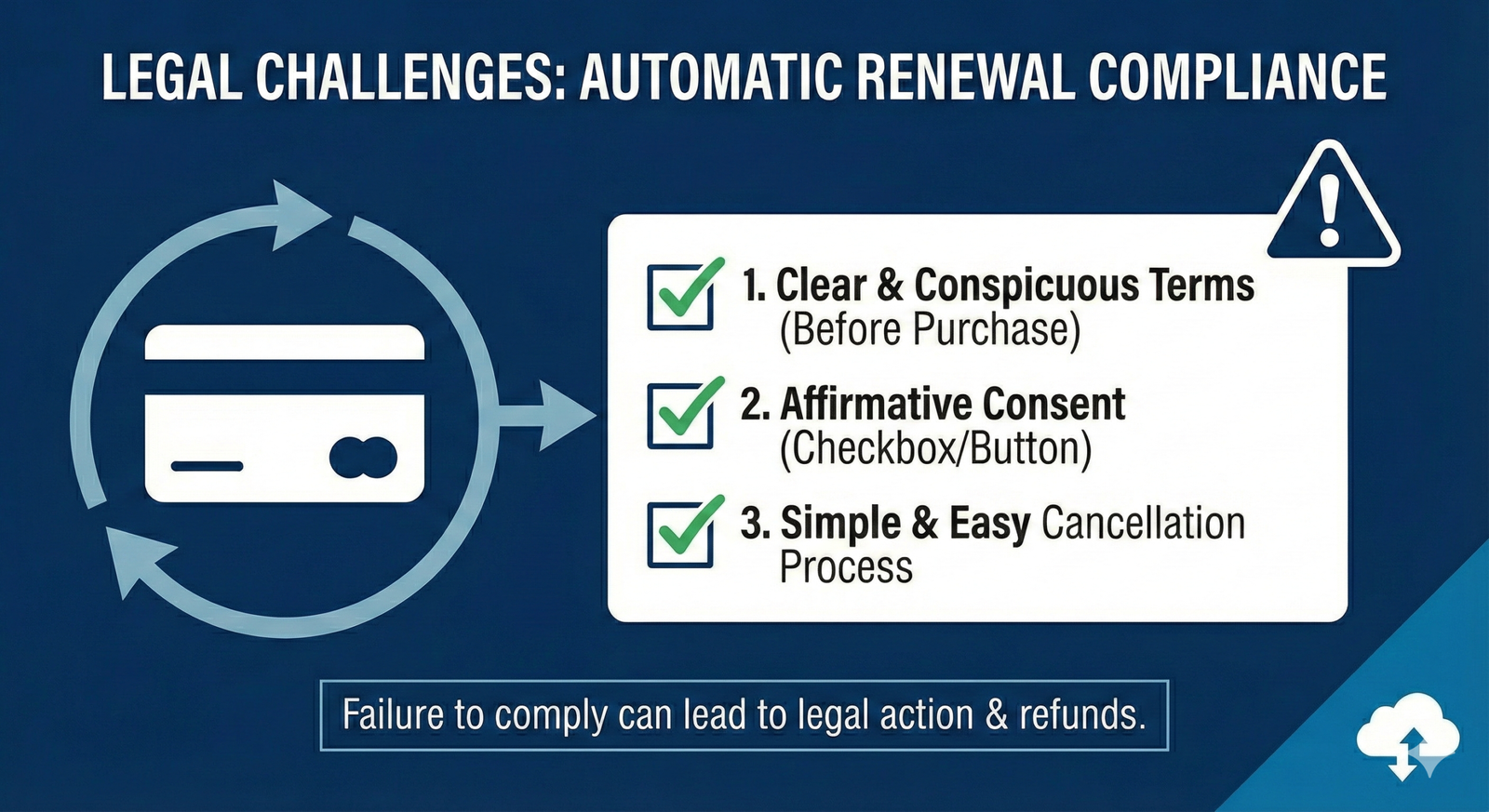

Legal Compliance: Navigating the Regulatory Landscape 📜

The legal landscape for recurring revenue models, particularly subscriptions, is rapidly evolving and becoming increasingly stringent.

Consumer protection agencies are focusing heavily on transparency, especially regarding automatic renewals and cancellation policies.

Failure to comply can result in significant fines and class-action lawsuits.

1. Automatic Renewal Laws (ARLs)

Many jurisdictions, including California, New York, and the European Union, have specific laws governing auto-renewing subscriptions.

These laws typically require three things: clear and conspicuous disclosure of the renewal terms before purchase, affirmative consent from the consumer, and a simple, easy-to-use cancellation mechanism.

Furthermore, many laws mandate a clear reminder notification be sent to the customer a set number of days before the renewal charge is processed.

Cozza Law notes that legal challenges include automatic renewal laws, privacy and data security, and consumer rights, such as the right to cancellation. Compliance with these laws is a continuous legal obligation.

2. Data Privacy and Security

Recurring revenue models inherently involve the continuous collection and storage of customer data, including payment information.

Compliance with global regulations like GDPR (Europe) and CCPA (California) is mandatory.

This means implementing robust security measures, clearly defining data usage in privacy policies, and providing customers with the right to access or delete their data.

The administrative cost of maintaining this level of data security and compliance is a necessary expense for RRM businesses.

3. Terms of Service and Cancellation Policies

Your Terms of Service (ToS) must be crystal clear regarding the recurring nature of the charge, the price, the billing frequency, and the process for cancellation.

A “simple, easy-to-use cancellation mechanism” is a legal requirement in many places.

Burying the cancellation link or requiring a phone call to cancel is a common practice that is increasingly being challenged and penalized by regulators.

The administrative process for handling cancellations must be as streamlined as the sign-up process.

Deep Dive: The Software-as-a-Service (SaaS) Model ☁️

The SaaS model is the quintessential recurring revenue example, dominating the B2B and B2C software landscape.

It operates on a pure subscription basis, offering access to software hosted in the cloud.

Its success is built on low upfront costs for the customer and high-margin, predictable revenue for the provider.

SaaS Pricing and Administrative Tiers

SaaS companies often employ tiered pricing to capture different market segments.

The administrative complexity increases with the number of tiers and the features included in each.

- Freemium: A free, limited version of the product is offered to attract a large user base, with the administrative goal of converting users to paid tiers.

- Per-User Pricing: The cost scales with the number of employees or users, simplifying revenue forecasting but requiring administrative tracking of user licenses.

- Feature-Based Pricing: Tiers are defined by the features unlocked, requiring administrative systems to manage feature access permissions precisely.

The administrative challenge in SaaS is managing the constant flux of upgrades, downgrades, and user additions while maintaining accurate revenue recognition.

Legal and Administrative Best Practices for RRM Success 🏆

To mitigate risk and maximize the value of your recurring revenue stream, a few best practices are non-negotiable.

These practices integrate legal compliance with efficient administration.

Best Practice 1: Transparency in Billing

Always over-communicate the billing terms.

Use clear, large font for the auto-renewal terms at checkout.

Send a pre-renewal notification email 30 days before an annual charge.

This transparency builds trust and is the best defense against regulatory scrutiny and chargebacks.

Best Practice 2: Simplified Cancellation

Make the cancellation process as easy as the sign-up process.

A simple, one-click cancellation link in the user’s account settings is ideal.

While it may seem counterintuitive, an easy exit reduces customer frustration and can lead to a higher rate of re-subscription later.

Focus on winning the customer back, not trapping them.

Best Practice 3: Dedicated Subscription Management Software

Do not try to manage recurring billing with standard accounting software.

Invest in dedicated subscription management platforms that automate dunning, handle complex tax calculations (especially for international sales), and provide built-in support for revenue recognition standards.

This investment is a critical administrative safeguard.

Best Practice 4: Continuous Legal Review

The regulatory environment for subscription services is constantly changing.

What was compliant last year may not be compliant today.

Schedule an annual review of your Terms of Service, Privacy Policy, and billing disclosures with legal counsel specializing in e-commerce and subscription law.

Investment News highlights the need for advisors to keep state and federal regulators’ compliance expectations in mind when offering subscription-based services. Proactive compliance is cheaper than reactive litigation.

The Future of Recurring Revenue: AI and Personalization 🤖

The next wave of recurring revenue models will be driven by Artificial Intelligence (AI) and hyper-personalization.

AI is enabling a shift toward “Outcome-Based Pricing,” where customers pay not for access or usage, but for the measurable results delivered by the service.

This model is administratively complex but offers immense value to the customer.

For example, a marketing service might charge a recurring fee based on the number of qualified leads generated, rather than a fixed monthly retainer.

This requires sophisticated administrative systems to track and verify the agreed-upon outcome metrics.

The legal agreements for outcome-based models must be extremely precise, defining the metrics, the measurement period, and the dispute resolution process.

The administrative and legal teams must work together to define the “success” that triggers the recurring payment.

The rise of AI-driven business models is creating new recurring revenue opportunities that were previously impossible. The ability to monetize data and intelligence is the new frontier.

Summary of Model Types and Legal Focus 📝

To summarize the administrative and legal focus for the primary RRM types, the following table provides a quick reference.

| Model Type | Primary Legal Focus | Primary Administrative Focus |

|---|---|---|

| Subscription (SaaS, Media) | Automatic Renewal Laws, Data Privacy (GDPR/CCPA). | Revenue Recognition (ASC 606), Churn Management, Dunning. |

| Usage-Based (Cloud, Utilities) | Fair Billing Practices, Transparency of Usage Metrics. | Real-time Metering, Complex Invoicing, Cost of Goods Sold (COGS) tracking. |

| Retainer (Services) | Scope of Work Definition, Termination Clauses, Intellectual Property Rights. | Time Tracking, Resource Allocation, Utilization Rate. |

| Consumables (Replenishment) | Shipping and Fulfillment Regulations, Product Liability, Auto-Renewal Laws. | Inventory Forecasting, Logistics Automation, Customer Retention. |

Each model is a unique blend of opportunity and administrative overhead.

The key to success is to treat the administrative and legal infrastructure as a core product feature, not an afterthought.

For a deeper understanding of the financial metrics, Investopedia provides an excellent resource on calculating and interpreting recurring revenue. Mastering the metrics is essential for valuation.

Further Resources on Recurring Revenue 📚

To continue your education on the intricacies of recurring revenue models, consult these resources.

Understanding the struggles of the subscription-based business model is crucial for planning.

StaxBill outlines 13 real struggles, including churn and revenue recognition, which provide a practical counterpoint to the hype.

A realistic view of the challenges is the first step toward overcoming them.

Video Guides to RRM

Conclusion: The Future is Recurring 🔮

The shift to recurring revenue is a defining trend of the 21st-century economy.

It offers unparalleled stability and valuation potential.

However, the success of any RRM hinges on meticulous administrative execution and rigorous legal compliance.

By understanding the nuances of each model and prioritizing transparency and ease of cancellation, businesses can harness the power of predictable income.

Treat your legal and administrative framework as your competitive advantage, and your recurring revenue model will thrive.

Plan for the long term, and build a business that pays you while you sleep. 😴